Funding

As a SSA issuer, we provide our clients the financial services to enable social impact. The main instrument in our funding strategy is to issue bonds on the capital markets.

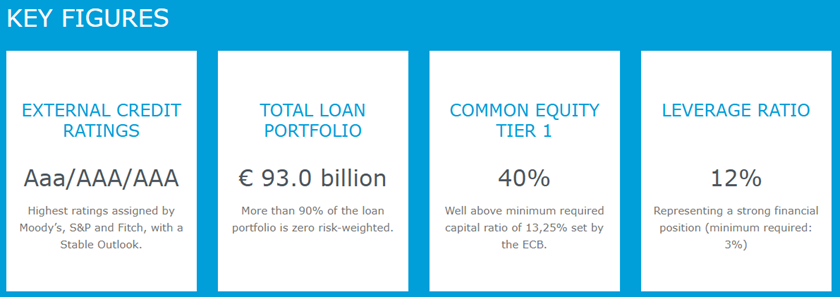

Key figures for funding

Funding strategy

BNG Bank is one of the largest issuers in The Netherlands. Our funding policy is designed to maintain a competitive advantage.

Issuance programmes

BNG Bank offers bonds via different programmes and currencies in order to obtain its funding. BNG Bank uses has issuance programmes both for the international money and international capital markets.

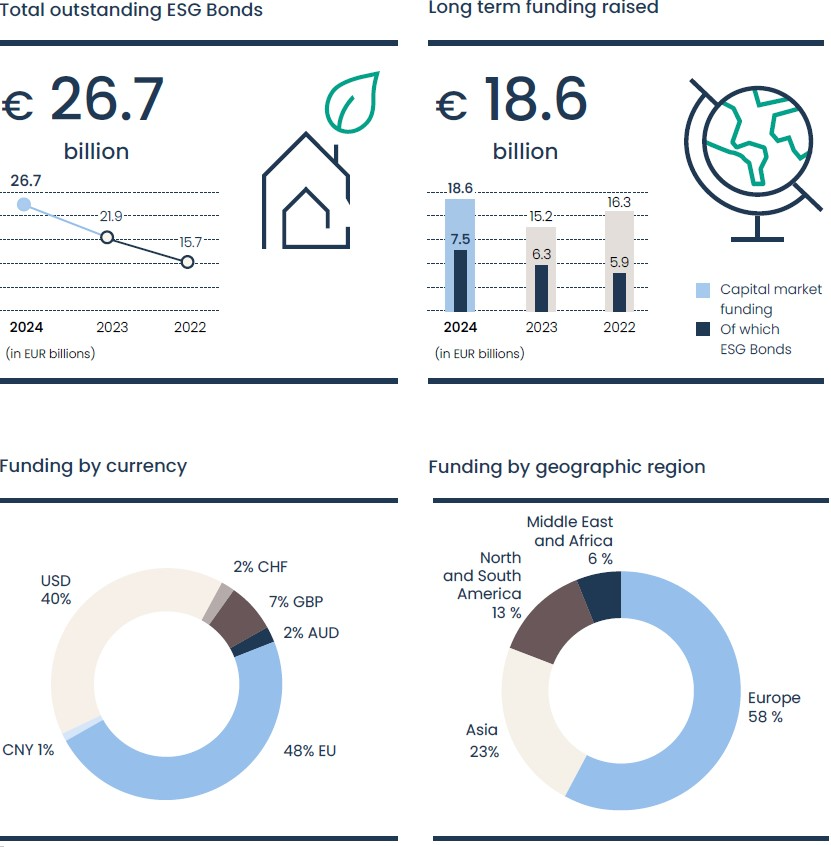

ESG framework

Under its Sustainable Finance Framework (ESG Framework), BNG Bank issues ESG labelled bonds under which the invested proceeds are ampped to the expenditures of Dutch municipalities and Dutch social housing associations. The expenditures are mapped to the ICMA GBP and SBP categories, as well as to the 17 SDGs of the United Nations.

BNG Bank bonds overview

As a promotional lender, BNG Bank raises funding in the capital markets by issuing bonds. Bonds that are issued by BNG Bank can help investors achieve both their financial and sustainability ambitions.

Historical statistics funding