Interim Report 2022: Major increase in lending and growth of loan portfolio

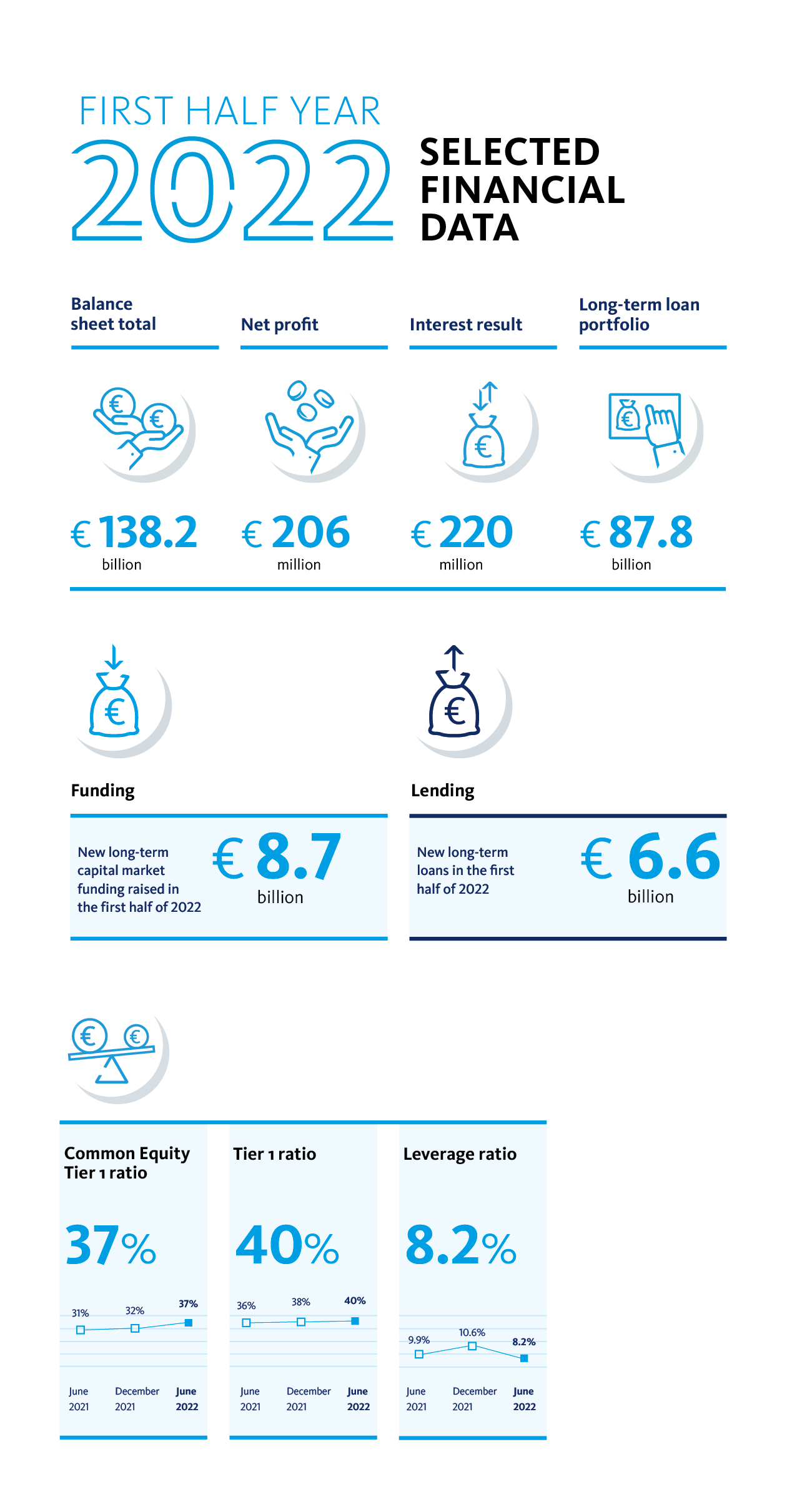

• Interest result came to EUR 220 million, net profit amounted to EUR 206 million.

• Strong capitalisation: Common Equity Tier 1 ratio of 37%, and Tier 1 capital ratio of 40%.

• EUR 8.7 billion in long-term funding was raised, of which over EUR 3.5 billion in SDG Bonds.

Financial

BNG Bank has a healthy financial position. In the first half of 2022, we achieved an interest rate result of EUR 220 million, and our net profit for this period amounted to EUR 206 million. The increase in the net profit (first half of 2021: EUR 187 million) was mainly due to a reduction in the provisions for expected credit losses, and a higher result on financial transactions.

BNG Bank continues to have a strong capital position, with a Common Equity Tier 1 ratio of 37%, and a Tier 1 capital ratio of 40%. Thanks to this strong capitalisation, as well as our low risk profile and triple A ratings, our bonds remain attractive even in these times of uncertainty. In the first half of 2022, we raised EUR 8.7 billion in long-term funding. This included the highly successful issue of four new SDG Bonds (related to the Sustainable Development Goals) with a volume of over EUR 3.5 billion.

Strategy

In the first half of 2022, BNG Bank continued to implement its ‘Our Road to Impact’ strategy. The financing of the transitions of our clients is helping us to achieve the maximum social impact together. In order to strengthen our strategic partnership with clients, a decision was made to modify the commercial organisation.Making an impact through partnerships

Gita Salden, CEO BNG Bank: ‘As a public bank, we have the same interests as our clients. BNG Bank wants to help make the Netherlands better and more attractive; we achieve this mainly through our loans, but also by connecting the various players in the public domain, based on our expertise as a bank. A good example of this is the prepaid card for Ukrainian refugees. In 225 municipalities in the Netherlands, BNG Bank’s prepaid card offers a solution for refugees from Ukraine. The debit card is an initiative of BNG Bank and was previously used by municipalities for homeless people. Thanks to good cooperation with various parties involved, we were able to make the card suitable for Ukrainian refugees within just a few weeks and quickly scale up production.

Outlook for 2022

We expect to achieve our full-year target of granting new solvency-free long-term loans for a total amount of EUR 9.8 billion. In the second half of 2022, we will also continue to optimise our organisation in order to improve its alignment with client wishes. The measurement of our clients’ impact will be carried out for the second time. In addition, BNG Bank’s climate action plan will be published.

Download the Interim Report 2022 of BNG Bank

-

Frederike Versloot, Spokesperson

Earlier Interim reports

- BNG Bank Interim Report 2024

- BNG Bank Interim Report 2023

- BNG Bank Interim Report 2022

- BNG Bank Interim Report 2021

- BNG Bank interim report 2020

- BNG Bank Interim report 2019

- BNG Bank Interim report 2018

- BNG Bank Interim report 2017

- BNG Bank Interim report 2016

- BNG Bank interimreport 2015

- BNG Bank interim report 2014

- BNG Bank interim report 2013

- BNG Interim Report 2012

- BNG Interim Report 2011

- BNG Interim Report 2010

- BNG Interim Report 2009