PCAF report 2020 - CO₂ gas emissions of BNG Bank clients decreased

25 March 2021

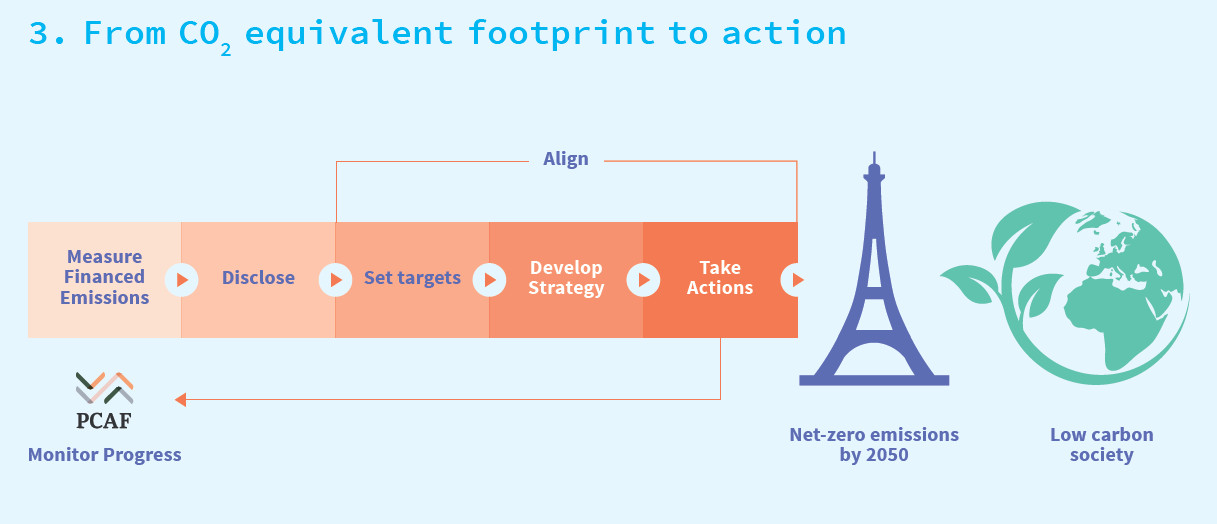

In 2019, BNG Bank, together with virtually the entire Dutch financial sector, committed itself to reducing CO₂ emissions. As part of this commitment, BNG Bank conducts an annual measurement of the impact of lending on climate change. For this purpose, BNG Bank adheres to the widely supported method of the Partnership for Carbon Accounting Financials (PCAF), which was further elaborated for BNG Bank by the Tilburg University research department Het PON & Telos.

The report shows that the CO2 emissions of the loan portfolio fell by 122 kilotons in reporting year 2020 (calendar year 2019), while both the loan portfolio and the percentage of the portfolio of which CO2 emissions are measured grew. Emissions per million of euros decreased by nearly 8%.

One of the main reasons for this decrease is that social housing units have been made more sustainable. For municipalities and other local authorities, the decrease was mainly achieved through the purchasing of goods and services. By way of an example, Het PON & Telos carried out in-depth research into the reduction in CO2 emissions achieved thanks to the new biodigester of the Frisian waste processing company Omrin. Here, the bank’s financing enabled the avoidance of 3.7 kilotons of CO2 equivalent emissions.

BNG Bank’s own gross CO2 emissions fell by 42% to 221 tons in 2020. As a result of the coronavirus pandemic, there were almost no business flights and the amount of fuel consumed by the lease car fleet decreased. As the bank has taken compensatory measures for 300 tons of CO2 equivalent emissions, its net carbon footprint is negative.

In 2022, the bank will present action plans to further reduce greenhouse gas emissions in line with the Climate Agreement. This fits in with BNG Bank’s ambition, as a partner of the public sector, to contribute to sustainable cities and communities in order to achieve even more social impact.

BNG Bank sharpened its strategy in 2020. Based on its stated purpose of being ‘driven by social impact’, the bank chose to focus solely on the public sector. In doing so, it is concentrating on four Sustainable Development Goals (SDGs), in relation to which the bank can make a difference through cooperation with its public clients. These SDGs are:

- Good health and well-being (SDG 3)

- Quality education (SDG 4)

- Affordable and clean energy (SDG 7)

- Sustainable cities and communities (SDG 11)

-

Frederike Versloot, Spokesperson

BNG Bank PCAF 2020 report extended (pdf, 1.1 MB)

BNG Bank PCAF 2020 report summary (pdf, 1.1 MB)

BNG Bank PCAF Methodology approach report October 2020 (pdf, 2.0 MB)