Interim Report 2021: loan portfolio BNG Bank on course

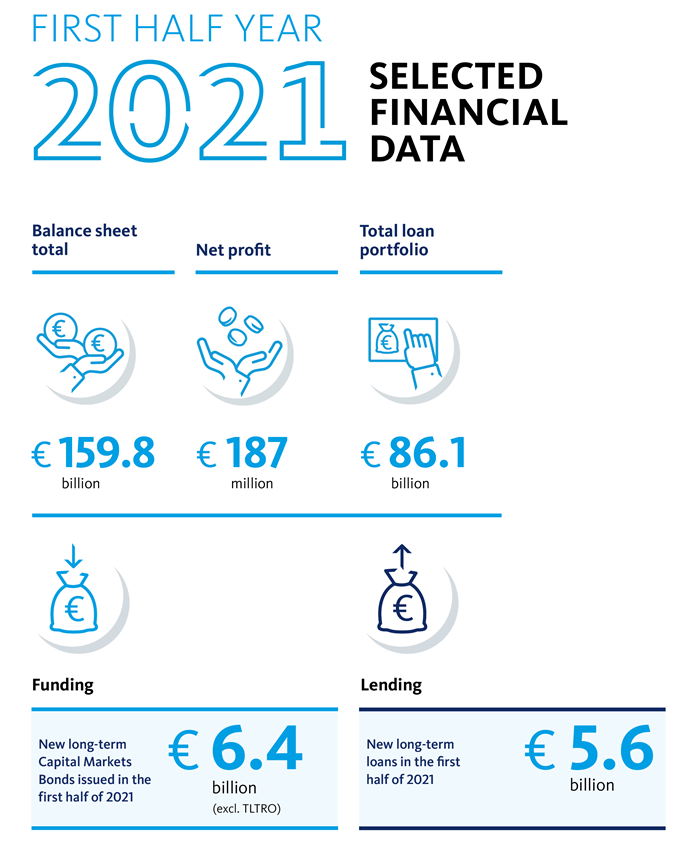

• Long-term loan portfolio stable at EUR 86.1 billion

• Net interest income increases by EUR 3 million to EUR 228 million

• Net profit of EUR 187 million

• Remaining dividend for 2019 and 2020 to be paid out in October

• Operating expenses increase by EUR 4 million

‘We are satisfied with our financial results,’ says Gita Salden, Chief Executive Officer of BNG Bank. ‘We can look back on a good first half-year in which we were able to provide our public-sector clients with long-term loans worth EUR 5.6 billion. We are reporting an increase in our net profit, primarily due to an improved economic outlook, which is resulting in lower loan impairments and a better result on financial transactions.

The underlying net interest income increased by EUR 3 million to EUR 228 million; we passed the favourable short term ECB funding rates on to our clients. We are on track with our “Our road to impact” strategy, which we are using to continuously enhance our social impact.’

Financial results

BNG Bank can look back with satisfaction on the financial results of the first half year. BNG Bank’s net profit for the first half of 2021 amounted to EUR 187 million. The increase of EUR 87 million compared to the first half of 2020 can be attributed to the diminishing impact of the COVID-19 pandemic on Western economies. In particular, the improved economic outlook is positively effecting the bank’s results on financial transactions and the model-based loan impairments.Increased operating expenses of EUR 4 million

Compared to the same period in 2020, regular consolidated operating expenses rose by EUR 4 million to EUR 48 million. As anticipated, staff costs and the hiring of external support saw a particular increase, to allow the bank to continue to fulfil its client integrity and gatekeeping responsibilities.Dividend payout

In late July 2021, the ECB announced that it would end the dividend restrictions starting 1 October 2021. BNG Bank will pay out the remaining dividend of EUR 148 million in October.

-

Frederike Versloot, Spokesperson

Earlier Interim reports

- BNG Bank Interim Report 2024

- BNG Bank Interim Report 2023

- BNG Bank Interim Report 2022

- BNG Bank Interim Report 2021

- BNG Bank interim report 2020

- BNG Bank Interim report 2019

- BNG Bank Interim report 2018

- BNG Bank Interim report 2017

- BNG Bank Interim report 2016

- BNG Bank interimreport 2015

- BNG Bank interim report 2014

- BNG Bank interim report 2013

- BNG Interim Report 2012

- BNG Interim Report 2011

- BNG Interim Report 2010

- BNG Interim Report 2009