Annual report 2020

Thanks to the safety net established by the government and the health insurance companies, the financial impact for the healthcare sector has been limited. While the pandemic is affecting the creditworthiness of many clients, this did not lead to additional individual impairments in 2020.

Driven by social impact

BNG Bank sharpened its strategy in 2020. Based on its stated purpose of being ‘driven by social impact’, the bank chose to focus solely on the public sector. In doing so, it is concentrating on four Sustainable Development Goals (SDGs), in relation to which the bank can make a difference through cooperation with its public clients.

These SDGs are:

- Good health and well-being (SDG 3)

- Quality education (SDG 4)

- Affordable and clean energy (SDG 7)

- Sustainable cities and communities (SDG 11)

‘I am proud of our “Road to Impact” strategy and the ambitions conveyed through this programme. I feel confident that it will further boost the energy of our dedicated employees and enable us, together, to make an even stronger impact on society,’ says CEO Gita Salden.

Financial results

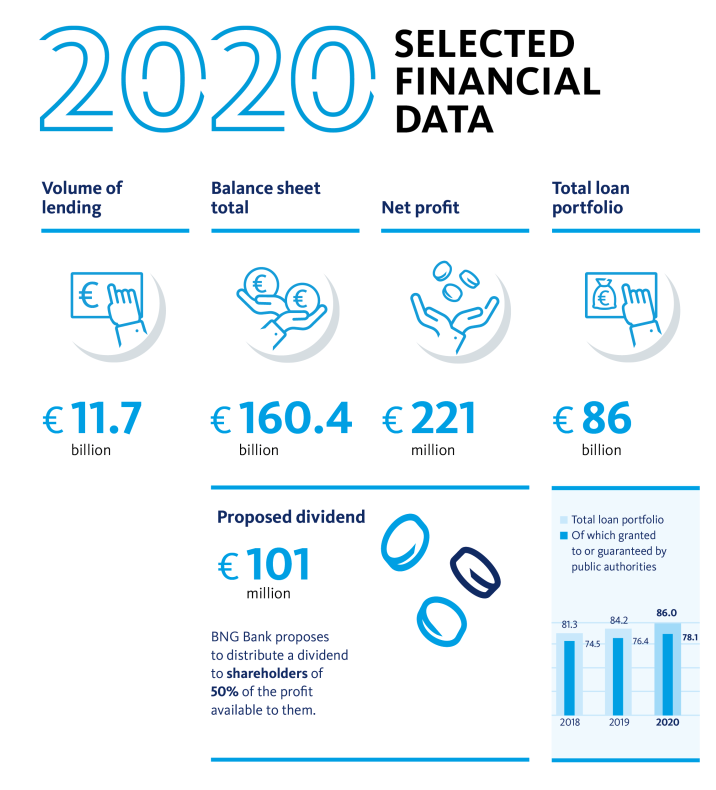

Rather than maximising profit, BNG Bank seeks to achieve social impact and a fair return on equity for its public authority shareholders. The net profit for 2020 amounted to EUR 221 million, despite extremely low interest rates. The 36% increase in profit is due primarily to a historically high one-off expected credit loss provision made in 2019.

In accordance with its capitalisation and dividend policy, BNG Bank proposes a dividend payment of EUR 101 million (EUR 1.81 per share). This is 50% of the net profit for 2020 after deduction of the compensation paid out to holders of hybrid capital. Distribution of the 2020 dividend will not take place before 30 September 2021 and is subject to any future ECB recommendations.

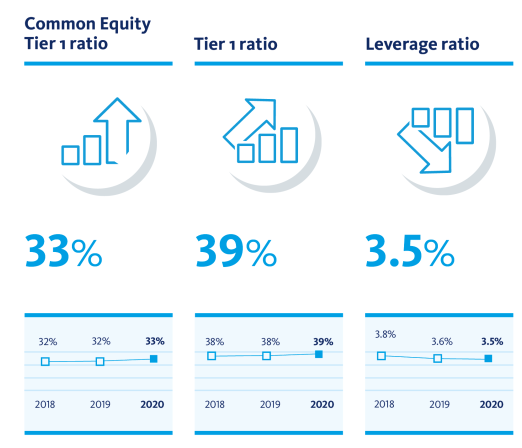

Risk-weighted solvency ratios

The risk-weighted solvency ratios of the Bank have remained at a high level. As of year-end 2020, the Common Equity Tier 1 ratio and the Bank's Tier 1 ratio are 33% and 39%, respectively. The leverage ratio amounted to 3.5% at the end of 2020.

Rating agency Fitch recently confirmed BNG Bank's AAA rating, while Moody's and S&P have awarded BNG Bank the highest rating category as well. This places BNG Bank among the safest banking institutions in the world.

Governance

A new senior management structure was introduced on 1 March 2021, comprising an Executive Committee consisting of five members. This Committee is made up of the current Executive Board, with the addition of a Chief Commercial Officer (CCO) and a Chief Operating Officer (COO). The CCO will be responsible for translating our key external strategic priorities into actions. The COO will bring information technology expertise and leadership to the executive level.

Financial outlook for 2021

BNG Bank expects to extend EUR 11.5 billion in new long-term loans to its public clients in 2021. This year, as well, clients will be facing the consequences of the COVID-19 pandemic.

BNG Bank intends to continue doing everything possible to support its clients where needed. The funding policy of BNG Bank will maintain its focus on ensuring permanent access to the money and capital markets for the terms and volumes required at the lowest possible rates.

The financial markets are expected to remain quite volatile this year. Therefore, we do not consider it wise to make a statement on the expected net profit for 2021.

-

Frederike Versloot, Spokesperson